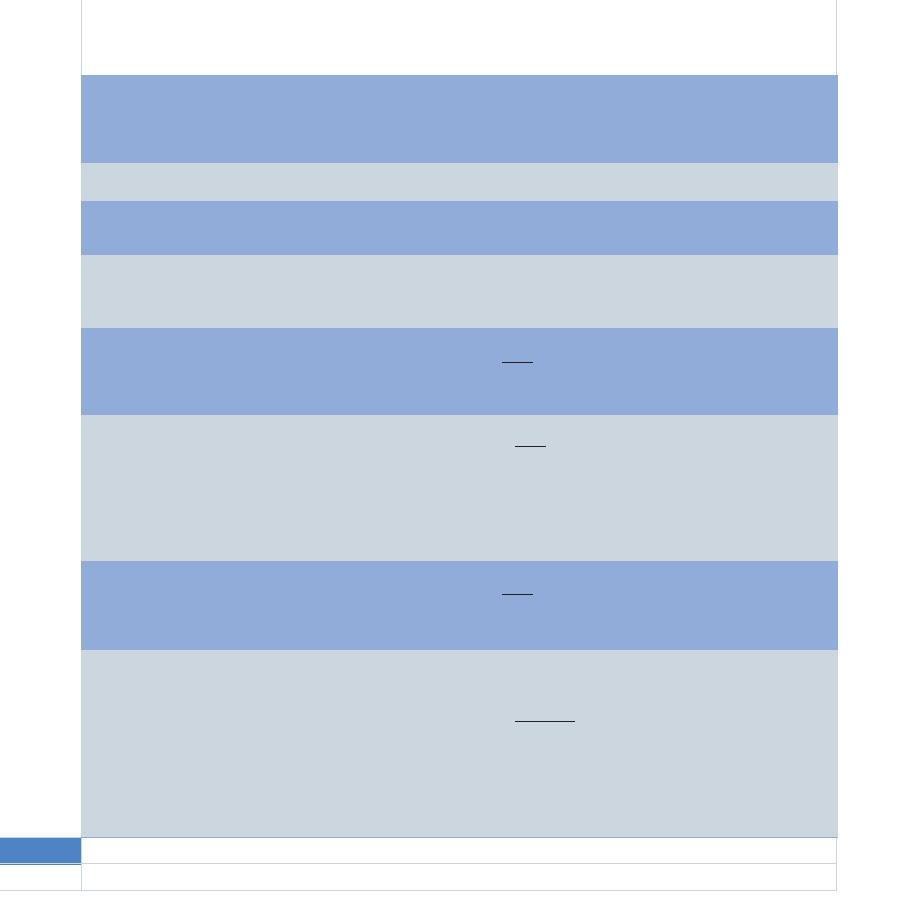

Table 1-1

LCC Formulas

Type of Cost

Cost Examples

Present Value Relationships

Comments

Design Fees

Not Applicable

Costs are not included

Sunk

Funds irrevocably committed

in the Analysis

Investment Costs

PV = TV

For those investment costs

First

Construction Costs

that begin at the start of the

Purchase Price

analysis period

Scrap value of equipment

Present value equals the

Salvage Value

FV

at the end of its service life

PV =

future value at the end of

(1+d) n

the service life, discounted

where FV=TV(1+e) n

by n service years

One time investments

Discount the future value

Future Investment

(1+e) n

occurring after the start

PV = TV (1+d) n

(Today's Value escalated at

of the analysis period

rate e to year n) back to the

Non-Annual maintenance

Where FV is the time pro-

present.

or repair

rated amount that separates

Major alterations to

investment value to the end

initial investment work

of service life salvage value.

Residual Value

Equipment with a service life

Residual value equals the

FV

extending beyond the analysis

PV =

future value at the end of

(1+d) n

period

the analysis period, dis-

counted to the present.

Annually Recurring Fixed

Fixed payment service

Annually Recurring Cost,

contracts with inflation

PV = TV(UPW)

relating to today's value,

adjustments

where

which increase in price at

(1+d) n 1

Preventative maintenance

UPW =

the same rate as general

d(1+d) n

inflation. The UPWn

factors are within the

NIST BLCC program.

24 F A C I L I T I E S S T A N D A R D S

FOR THE

PUBLIC

BUILDINGS

SERVICE

1.8 Life Cycle Costing

Revised March 2005 PBS-P100

Previous Page

Previous Page